Chapter 1: Forex Origins

The history of the Forex market traces its roots back to ancient times when merchants engaged in cross-border trade. As early as the Babylonian period, people exchanged goods and currencies to facilitate commerce. However, the modern Forex market as we know it began to take shape in the 19th century with the establishment of the gold standard. This system pegged currencies to a specific amount of gold, providing stability to international exchange rates.

Chapter 2: Bretton Woods Era

After World War II, the Bretton Woods Agreement in 1944 played a pivotal role in shaping the Forex market. The agreement established a new international monetary system, with major currencies pegged to the US dollar, which, in turn, was linked to gold. This fixed exchange rate system aimed to stabilize global economies and promote international trade, setting the stage for a more organized Forex market.

Chapter 3: Floating Rates Emerge

The collapse of the Bretton Woods system in the early 1970s marked a significant turning point in Forex history. As countries moved away from fixed exchange rates, the era of floating exchange rates emerged. This allowed currencies to fluctuate freely based on market forces, leading to increased volatility but also providing traders with new opportunities to profit from currency movements.

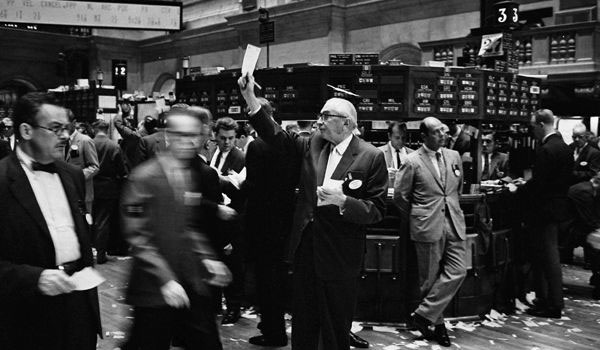

Chapter 4: The Rise of Retail Forex

In the 1990s, technological advancements and deregulation paved the way for the rise of retail Forex trading. Previously, the Forex market was predominantly accessible to institutional players. However, with the advent of online trading platforms, individual traders gained access to the currency markets, democratizing the world of Forex trading and opening up new possibilities for retail investors.

Chapter 5: Online Trading Revolution

The late 20th and early 21st centuries witnessed a revolution in Forex trading with the widespread adoption of the internet. Online trading platforms, real-time data feeds, and advanced analytical tools became widely available, empowering traders to execute transactions from the comfort of their homes. This accessibility, coupled with leverage and margin trading, contributed to the exponential growth of the retail Forex market.

Chapter 6: Future of Forex Markets

As we look ahead, the future of Forex markets holds exciting possibilities. The continued integration of technology, including artificial intelligence and blockchain, is likely to reshape the landscape. Additionally, the globalization of financial markets and the emergence of new economic powers may influence currency dynamics. Regulatory developments and advancements in trading infrastructure will play crucial roles in defining the future trajectory of the Forex market, ensuring its adaptability in an ever-changing financial landscape.